The Collateral Valuation Report (CVR) is an appraisal report based on CompCruncher, computer aided appraisal software. The CVR is produced by True Value Appraiser’s that are trained in real estate regression analysis. It is not an AVM embedded in a form filler. The appraiser is center stage and has complete control over the data analysis and the valuation process.

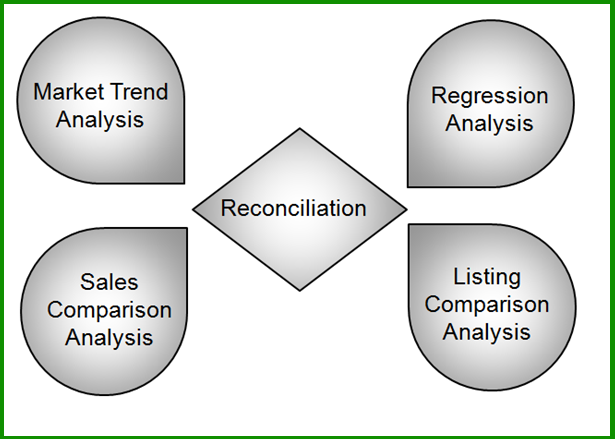

CompCruncher/Software: takes the ‘Art of Appraising’ and adds a little bit of Science to it. Each appraisal has four major analysis components:

• The Market Trends analysis to determine the activity and trends in the market;

• The Regression analysis to determine a reasonable market valuation and the value of the property characteristics which can support your adjustments;

• The Sales Comparison approach to get an indicated value based on historical sales;

• The Listing Comparison approach to provide an indicated value based on future sales.

Each analysis is dependent on the others. For instance, the Sales/Listing ratio is used to normalize the Listing Price so that the adjustments used in Sales Comparison can be used in the Listing Comparison; Regression provides a reasonableness and support for adjustments. The elegance of this system is that all four analyses synchronize to produce a highly supportable Value Conclusion.

CVR Use

You can use the CVR for any valuation service except for re-finance and loan origination. Refinance and loan origination are governed by Fannie Mae and Freddie Mac and you need to use their approved forms for that type of appraisal work.

We have found that lenders and appraisers use the CVR for their alternative valuations. Here are some suggestions for you to understand the great use of the CVR across the multi-billion alternative valuation market:

• Bail Bondsmen

• Estate work

• Divorce disputes

• Tax assessment challenges for the tax assessor and/or home owners

• Forensic appraisals

• Legal work

Lenders have told us that the CVR is a highly attractive alternative to provide more accurate and more reliable valuation with additional analytical features in the following areas:

• Replacement for BPOs, particularly for HELOCs

• A replacement to a URAR for portfolio loans (HELOCs, private clients, consumer finance, community banking)

• Default management for any BPOs used in the process (short sales)

• Alternative in the loan modification programs

• Quality assurance

• Secondary valuation in value dispute resolution and value reconciliation

CVR Turn Times

The turn time is yours to set. The recommended guideline is to promise 48 hours, but deliver within 24. If you get the order in the morning, deliver it in the afternoon.

The time it takes to complete a CVR report will vary between complexity of assignment and appraisers and their local factors. However, after completing the CompCruncher Education and Training program, All of the Appraiser’s at True Value Appraisal, Inccan complete a CVR report within an hour or two, sometimes much less.

Pricing

The pricing is normally set between $150 and $250

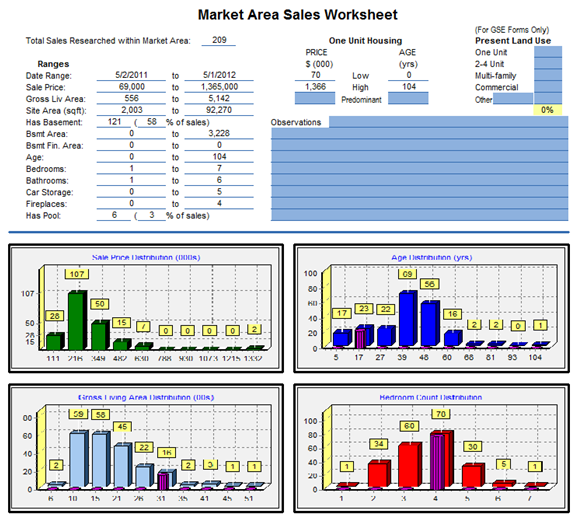

CompCruncher works with hundreds of properties. It analyzes entire markets. All this data can be over whelming to an individual, but not to software that is designed for this purpose.

CompCruncher will display the market characteristics in easy to understand histograms. In seconds you will get a detailed overview of the market and the subject. Quickly understand the relationships between current listings and previous sales and how it could affect the subject’s value.

Copyright © 2022 True Value Appraisal, Inc. All Rights Reserved. Designed & Developed by VIBGYOR